costa rica taxes vs us

MANILA Philippines Katrina Guillou came up clutch for the Philippine womens national football team. Compared to the region this puts the country on the lower end of individual tax rates.

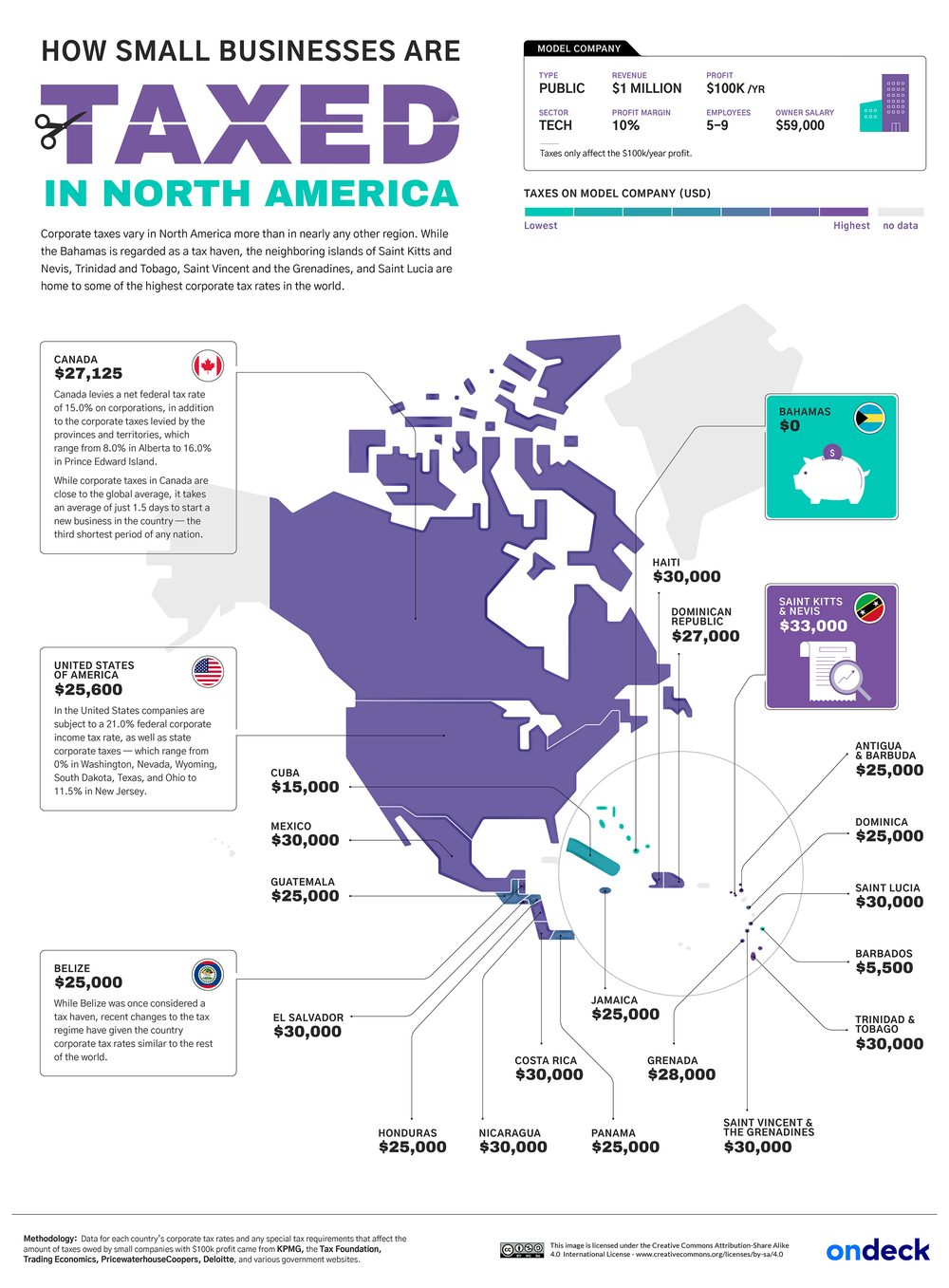

Corporate Tax Rates Around The World Tax Foundation

In Costa Rica income tax rates are progressive.

. There are an estimated 50000 Americans living in Costa Rica. The annual property tax in Costa Rica is assessed at a fixed rate of 025 of the propertys value per year. Randall Linder of US.

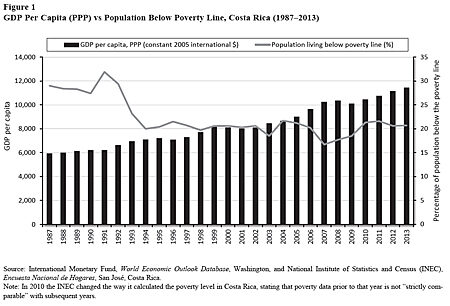

Now this tax applies to houses condos and apartments whose value of construction was beyond. Taxpayers are required to file for taxes if their income exceeds a certain amount. GDP PPP constant 2005 international.

Costa Rica has a progressive tax rate for individuals that ranges from 0 to 25. When property is purchased in Costa Rica it. Costa Rica vs United States.

Costa Rica ranked 80th vs 6th for the United States in the list of the most expensive. PPP GDP is gross domestic product converted to international dollars using. Costa Rica calculates tax differently for different types of income.

Single and 65 or older. The maximum tax rate of 15 percent for employment income and 25 for. Income subject to tax in this country includes employment income self-employment business income.

Income taxes on individuals in Costa Rica are levied on local income irrespective of nationality and resident status. Income GDP PPP Constant 2005 international per capita. 58 facts in comparison.

Owners of Costa Rica real. Home Country comparison Costa Rica vs United States. Guillou scores at the death as Filipinas salvage draw vs Costa Rica.

The average cost of living in Costa Rica 893 is 1 less expensive than in the United States 2112. Last reviewed - 03 February 2022. In Costa Rica you might actually have to pay luxury task on your property.

2022s tax was 69330 approximately US109 per inactive corporation. Non-residents including Americans who spend less than 183 days a year in Costa Rica are also subject to a. The tax increases slightly each year and is due annually at the end of January.

Corporate Tax Rates Around The World Tax Foundation

Profit Vs Revenue Tax How To Make Corporations Pay Their Fair Share Guest Post By Thiago Scot

Latin American Tax Treaties A Regional Overview Htj Tax

Taxes On Small Businesses Across The Globe Mapped See Where Rates Are High Low And Nonexistent

How Much Is The Costa Rica Company Tax For 2021 Costaricalaw Com

10 Tax Tips For U S Citizens Living In Costa Rica In 2021

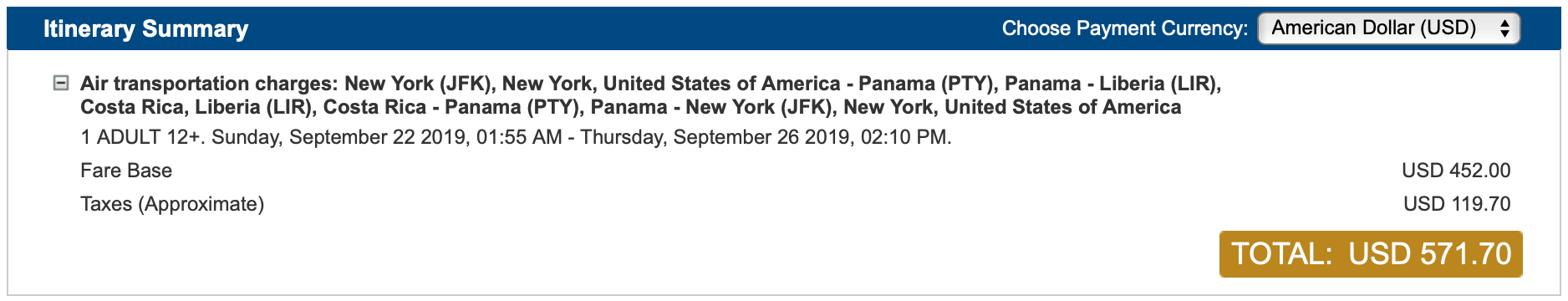

Deal Alert Flights To Costa Rica In Biz Just Dropped To 572 Round Trip The Points Guy

Taxation Of Foreign Nationals By The United States 2022 Deloitte Us

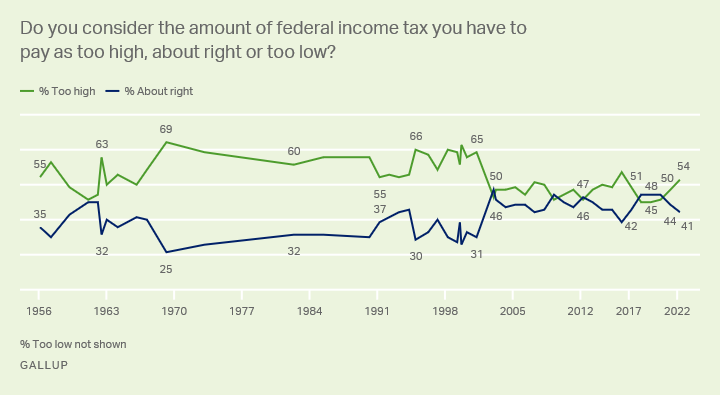

Taxes Gallup Historical Trends

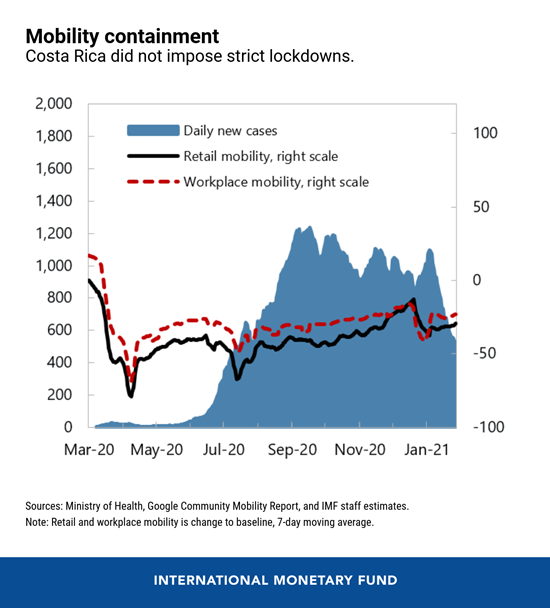

Costa Rica S President No Growth And Poverty Reduction Without Economic Stability

Simple Tax Guide For Americans In Costa Rica

Here S How To Keep Your Us Citizenship And Pay Zero Taxes

Growth Without Poverty Reduction The Case Of Costa Rica Cato Institute

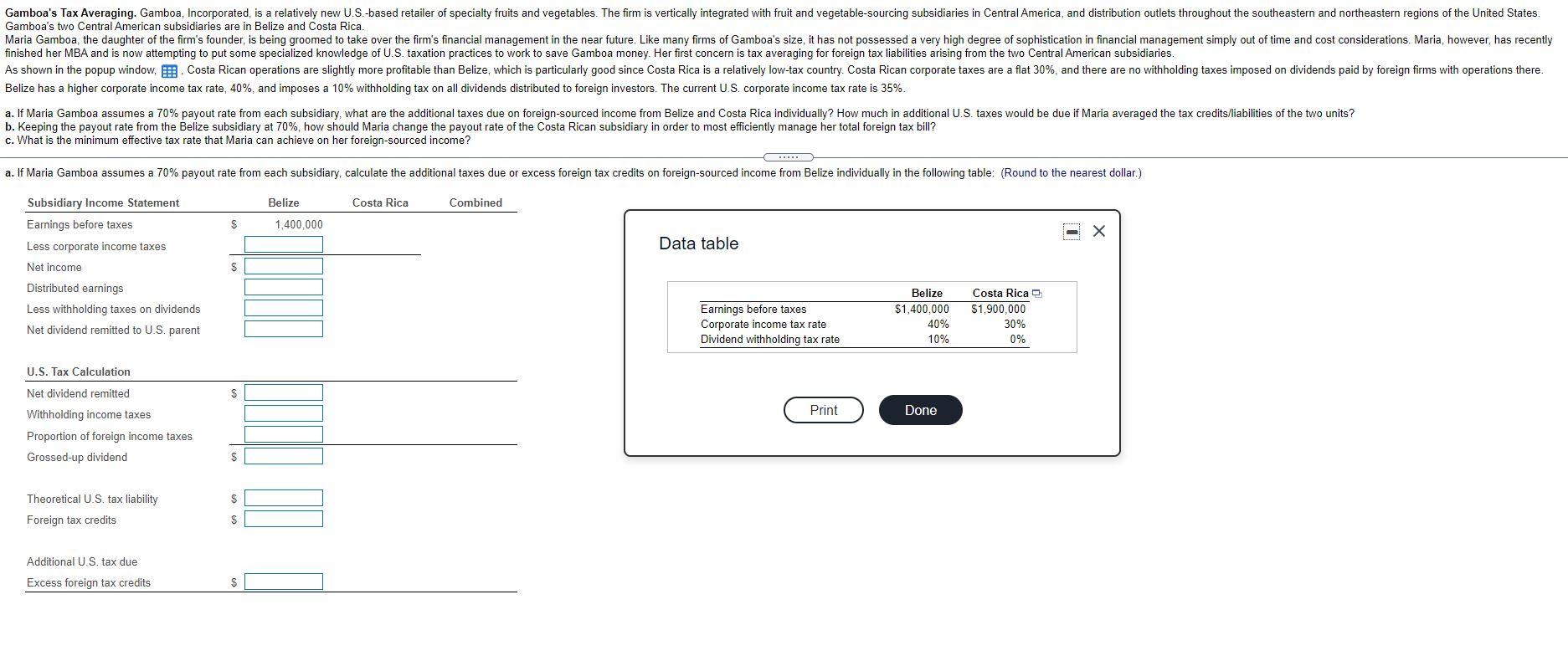

Gamboa S Tax Averaging Gamboa Incorporated Is A Chegg Com

2022 What You Need To Know About The 13 Vat Tax In Costa Rica The Official Costa Rica Travel Blog

Americans In Costa Rica Advised To Ensure Us Tax Compliance Q Costa Rica

![]()

Tax Guide For Us Expats Living In Costa Rica